The fate of the U.S. is going to be decided over the next year. O.K., I know

that’s overly dramatic, but here’s why I say it. The deficit-reduction

commission co-chaired by Erskine Bowles and Alan Simpson has put the

long-term fiscal health of the country front and center on the national

stage. If we’re lucky, we’ll have a serious debate about it. We could decide

that we are willing to undertake real reforms and fix the problem. Or we

could once again kick the can down the road. If we do the latter, things get

worse, the political deadlock hardens, and costs rise. Historians may well

look back and say this was the point at which the U.S. began its long and

seemingly irreversible decline.

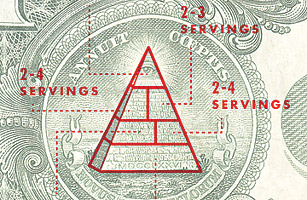

The problem we need to fix is simple. Americans have an appetite for

government benefits that greatly exceeds their appetite for taxes. For more

than a generation, we have squared this dishonest circle by borrowing vast

amounts of money. As more people age, this gap between what we want the

government to provide and what we are willing to pay for is going to widen

to an unsustainable level. Over the next 75 years, benefits under

entitlement programs will exceed government revenue by $40 trillion. The

federal budget deficit, if unattended, will reach 24% of GDP in 2040 —well beyond Greek and Irish territory. At that point, the measures it would

take to close the gap are so punitive — we’re talking tax hikes of 70% or

spending cuts of 50% — that it is inconceivable that we will make them.

If by some chance we were to make them, they would put the economy in a

death spiral.

Yet while the problem seems insurmountable, it really is not — at least

not at this point. The greatest service the co-chairs of the

deficit-reduction commission have done in their draft proposal is to make

that plain. Whatever you think of the ideas floated by the chairmen — and

I actually like most of them — they demonstrate that with a series of

phased adjustments, most of which are sensible policy anyway, the U.S. can

put its fiscal house in order; pay for a generous set of programs for the

elderly, poor and sick; and still maintain a very competitive tax system.

The proposals are currently being attacked from the left and right. The left

argues that they are regressive and politically conservative. But the Tax

Policy Center at the Brookings Institution has studied the proposals and

points out that in fact they raise revenues from the rich substantially more

than from the poor. Those on the left should ask themselves if it is really

too much to raise the Social Security retirement age by one year in 2050

— an adjustment that would affect people who are now 28 or younger and

hence have quite a bit of time to plan for the change — to keep the

system solvent.

The right, for its part, continues to live in an alternative universe where

there will be no need for more revenue, just cuts in spending — though of

course it makes no serious effort to describe which programs will be cut. In

fact, no matter how many programs you cut, you will need more tax revenue.

My preference would be for a national sales tax or value-added tax. Either

of those would be a highly efficient way to raise revenue because there is

almost no possibility of cheating. Moreover, such taxes have the effect of

encouraging savings and discouraging consumption.

The proposals by Bowles and Simpson, however, are just that: a series of

proposals designed to get a national conversation started. I wish they had

been bolder in outlining cuts to Medicare, which is the program that will

really cause the deficit to explode over time. But they have included all

kinds of topics normally off-limits. While this may not be the time to

implement it, why not discuss the tax deduction for interest on mortgages?

It costs the government $130 billion a year, encourages people to take on

too much debt, inflates the housing market and has no real effect on

homeownership. Canada has no such program and has the same rate of

homeownership that the U.S. does. Margaret Thatcher began the phased

elimination of the British mortgage-interest deduction, and the rate of

homeownership actually went up.

The crucial arena is not the economic realm but the political one. Will

moderates and centrists — who make up the majority in the U.S. — come

together and fight for a compromise that embraces ideas from both sides? Or

will this conversation turn into the usual demagoguery, with each side

tearing apart the things they dislike and ensuring that the deficit

commission becomes one more sad story about Washington’s inability to

grapple with our long-term problems? We’ve seen the political process break

down and avoid dealing with immigration reform, energy policy and Social

Security. Will we fail again, this time on the biggest test?

See TIME’s Pictures of the Week.

See TIME’s Cartoons of the Week.