At first, the investment sounded too good to be true to Emiko, a 74-year-old retired elementary school principal. But she ached to grow her retirement fund so she could take any burden or worry away from her two children. So Emiko invested conservatively, only the equivalent of a few hundred dollars at a time.

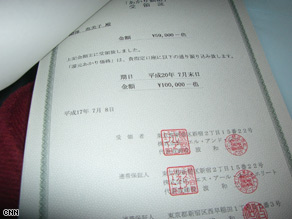

But then the returns started coming in. It was exactly as Kazutsugi Nami had promised, a 36-percent return on the money Emiko had invested with his firm, L&G. “I want to create a world where your money never disappears,” Nami told investors on an L&G promotional video from 2007. Emiko says Nami issued “enten” money, a quasi-currency Nami called “money from heaven.” She began to invest hundreds of thousands, watching her enten account grow. But then the returns stopped. Tokyo Metropolitan Police arrested 75-year-old Nami and 21 other executives of the now-bankrupt L&G on charges of organized fraud last week. Nami, chatting up reporters over a beer moments before his arrest, denied any wrongdoing. “Time will tell if I’m a swindler,” he said. “Time will tell.” Investigators say at least 10,000 people have alleged that they were swindled by Nami, a number that plaintiffs’ attorneys expect will at least triple. Plaintiffs’ attorneys say Nami wined and dined investors at giant parties in the ballrooms of expensive Tokyo hotels. The investors also used the enten money to purchase household items, clothes and jewelry at L&G markets. But the bigger scheme allegedly took place in a separate investment fund, into which Emiko poured thousands upon thousands. Emiko, who asked to withhold her last name, showed CNN her bank statement, showing a loss the equivalent of U.S. $400,000. “I’m ashamed of my stupidity. I’m so embarrassed,” she said. She’s also filled with anger when she thinks of the charismatic man she trusted with her retirement. “I despise him, to the point I wish I could kill him. He didn’t just do it to me. I involved three of my friends in this, too.” Although there are differences between the allegations of fraud against Wall Street’s Bernie Madoff and Japan’s Kazutsugi Nami, there are also parallels as well, said Temple University professor Jeffrey Kingston. “They were both smooth operators,” Kingston said. “They were moving in high-echelon circles and they wiped out the savings of a lot of people. I think the biggest parallel is the consequence for the investor. They’re left holding the bag and they have nothing left.” Emiko is not hopeful she’ll ever see any of the money she invested with Nami. Most of the money, according to her attorney, has gone to pay off early investors. Emiko says she’s working on staying healthy in her elder years, so she won’t burden her children — something she might now not be able to avoid.